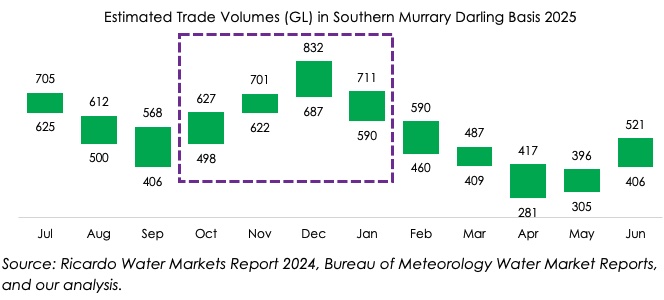

Water markets in Australia, as you might expect, experience their peak during the October to January summer period, with 40% of the total annual volume traded. In contrast, the March to June period, the trough of the market, only sees 25% of total annual trading volume.

Interestingly, July marks the start of new-season trading, with heightened activity driven by preparation buying and the establishment of allocations for the upcoming growing and irrigation season.

Government Buybacks Nearing Completion

Environmental recovery tenders are now closed, and 37.3 GL has been agreed to be repurchased, with premiums of between 15-25% being paid for General and High Security Entitlements.

Dry Conditions and Low Storage Levels

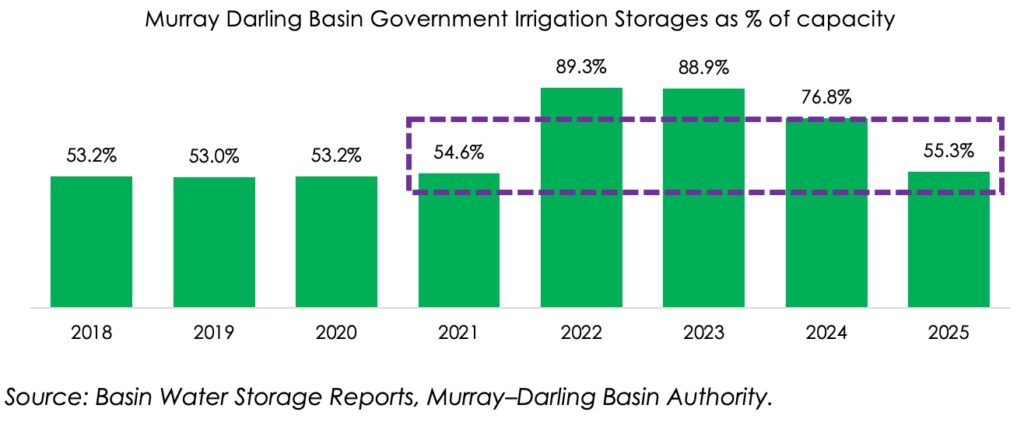

Persistent dry conditions are continuing to impact the market, with government storage levels currently sitting at 55%—a sharp decline from 76% at the same time last year. This marks the lowest level recorded since 2021, and serves as a strong reminder of the importance of strategic planning heading into the 2025–26 season.

Rural Co Outlook for 2025-26 Water Availability

- Murray and Goulburn systems should start with 25% HRWS or better.

- Average inflows should allow the Murray and Goulburn Loddon systems to reach 100% HRWS by mid-October 2025.

- With dry inflows, the Murray system is projected to reach 91% HRWS by 16 February 2025, and Goulburn is expected to reach 77% HRWS.

- High security entitlements in the NSW Murray and Murrumbidgee regions are projected to be 95%.

Please contact Shaannie Webb directly if you have any questions on 0429 554 480 or via email on: swebb@ruralcowater.com.au.

Era of Regulation for Investors and Trading

With a 20% increase in non-production investment, 61% of water market buyers in FY25 are now non-farmers. This shift—combined with the commoditisation of a $6.0 billion water market—has prompted a move toward greater regulation, which we see as a positive and necessary evolution. Strengthened oversight will help deter unethical behaviour, including insider trading and market manipulation, fostering a more transparent, robust, and trusted marketplace for everyone involved.

Key regulatory updates include:

- Mandatory Code of Conduct for Intermediaries: Water market intermediaries (brokers, exchanges, etc.) will be required to adhere to a standardized Code of Conduct to enhance transparency and prevent unethical practices.

- Enhanced Data Accuracy Requirements: All water trade participants in the Murray–Darling Basin must ensure that trade or transfer application forms are accurate and comprehensive. Records must be retained for five years.

- Expanded Regulatory Oversight: Regulatory bodies will take on expanded roles, ensuring better enforcement of regulations and supporting market education.